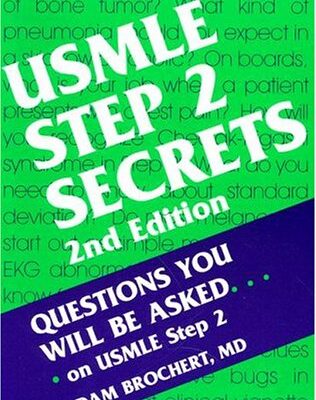

خرید و دانلود نسخه کامل کتاب Electronic Trading and Blockchain: Yesterday, Today and Tomorrow – Original PDF

54,500 تومان قیمت اصلی 54,500 تومان بود.27,500 تومانقیمت فعلی 27,500 تومان است.

تعداد فروش: 65

Author:

Richard Sandor

What Is FinTech? FinTech or financial technology refers to the new solutions which demonstrate innovation in the development of applications, processes, products or business models in the financial services industry using technology. FinTech should have four features. They need to be highly innovative, pioneering, disruptive and customer-focused. Technology will include the use of artificial intelligence (AI), big data, computational power, Internet of Things (IoT) or others. These solutions can be differentiated in at least five areas by customer segments like financial services or products built upon technology in the banking and insurance sectors shown in Table 1.1. We have earlier defined FinTech to be as general as possible to embody a broad range of technology applications and to include payments, investment, financing, insurance, advisory, cross-processed (bank/insurer/non-bank/non-insurer) and infrastructure services. There is no one definition agreed by all. Some may define FinTech as technology that increases efficiency and creates new financial business models that utilise some or all of the followings: AI, Blockchain, Cloud and Data Analytics. Others have defined FinTech companies as those applying emerging technologies to alter the current financial landscape, while TechFin companies are those that utilise technology to enhance existing financial capabilities. Still, others have viewed FinTech companies as those driven by the desire to use emerging technologies to disrupt the financial landscape, while TechFin companies are those using technology to enable efficiency improvements, preferring a less disruptive and a more incremental approach

نقد و بررسیها

هنوز بررسیای ثبت نشده است.